Our financial expertise enables transparent pricing, simplified transactions and negotiations and conveys comprehensible results.

We provide an independent and transparent valuation of renewable energy plants (wind and solar projects) in the form of a financial report.

Our valuations are individual and objective. The parameters are acquired from market data and the derivation of the results from the expert opinion-style document is transparent and easy to understand.

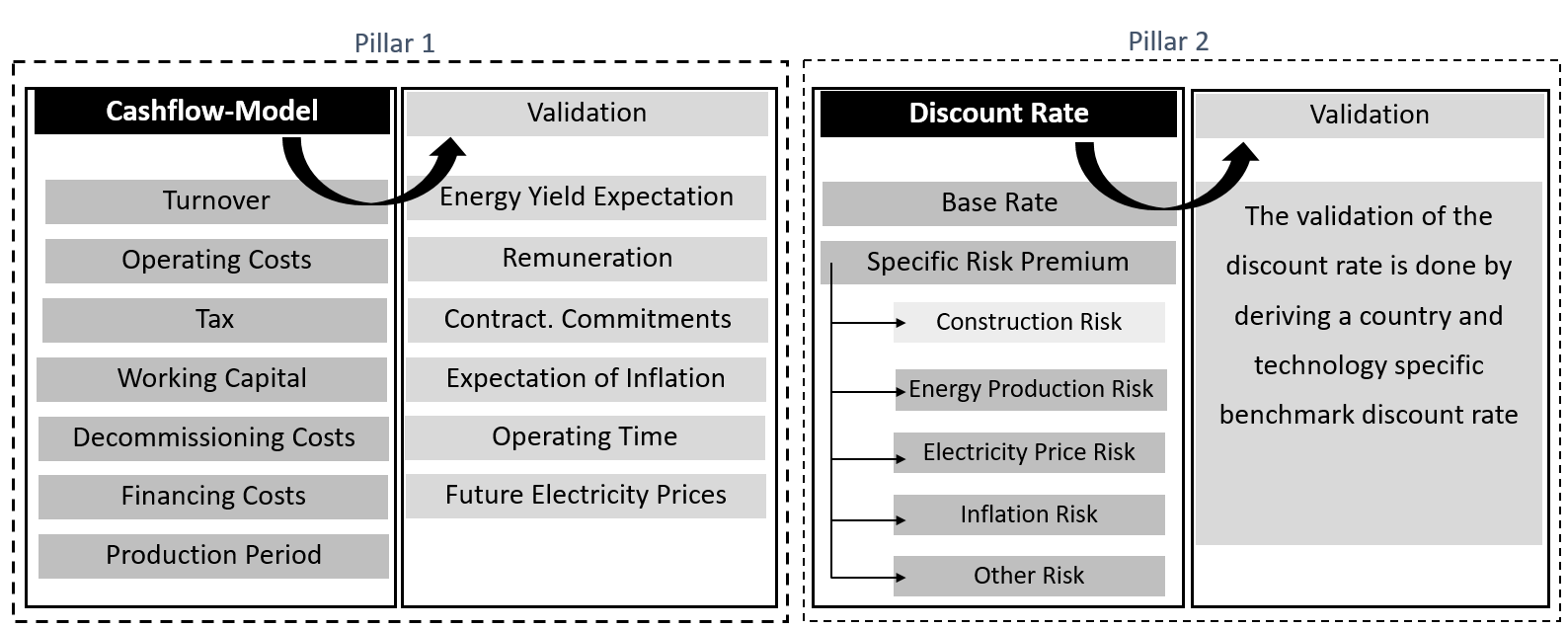

These characteristics, unique to us, are our distinguishing factor, as we do not use a universal company valuation model, disseminators, or flat-rate approaches, commonly used in the valuation market. Cash flows of projects are calculated objectively from the perspective of an investor's expectations, strengthening the informative value of the valuation. The discount rate is determined using a mathematical approach and is calibrated using a market-implied discount rate.

Because this approach requires good knowledge of the energy market, dependencies, and regulation, etc., we have specialised in several markets, with our main focus being on Germany and France. For projects in other countries, please contact us.

Building on the experience and knowledge gained in recent years, we have further developed the expert determination of market value. The focus being on the determination of fair values, which is of interest to various groups of people.

We provide independent assessments for:

- Project developers

- Managing directors of renewable energy plants

- Fund managers

- Banks and financial service providers

- Energy companies

- Tax consultants

Our evaluations are used for:

- Change of shareholders

- Transactions (full or pro rata)

- Financing negotiations

- Proof of creditworthiness

Our model is based on a Discounted Cash Flow (DCF) method and rests on two pillars.

Using a standardised and automated cash flow builder, we first create the cash flow structure over the complete life cycle of the project. Thanks to the mapping of payment flows during the year, we consider the individual production profile of the plant. We reconcile the remuneration and the operating costs with the contracts. We validate estimated positions against reference values and adjust them if necessary. As part of the process, we refrain from making hard assumptions. Thus, future electricity prices or operating costs are indexed using market inflation expectations, and taxes and depreciation are presented according to country-specific regulations.

More information can be found about our model under the tab heading, Useful information.

Model Features

| Objective: | Modelling of cash flows (individual components) from the investor's point of view. |

| Market-oriented: | As many parameters as possible are derived from the market (market data), avoiding any hard assumptions. |

| Transparent: | The discount factor is broken down into individual risk components. The transparency of our valuation is a matter of course for us. |

| Flexible: | Market value / sustainable market value / mortgage lending value Reference date-related vs. period-related |

| Individual: | All valuations are individual and are based on the characteristics of the investment (Performance, technology, term, remuneration, taxes, etc.) |

The company’s headquarters are in Luxembourg City.

Located in the heart of Europe, Luxembourg is the second largest investment fund centre in the world and the leader in Europe. As a prime location for the management and accounting of alternative investments (such as energy infrastructure), among others, €5.09 trillion is managed in Luxembourg (Luxembourg for Finance; AuM - as of 2021).

As independent financial appraisers and managing directors of RE-Valuation SARL-S, we also offer our valuation expertise to banks, funds, and financial service providers, among others, so that we are in constant exchange with experts within an international network.

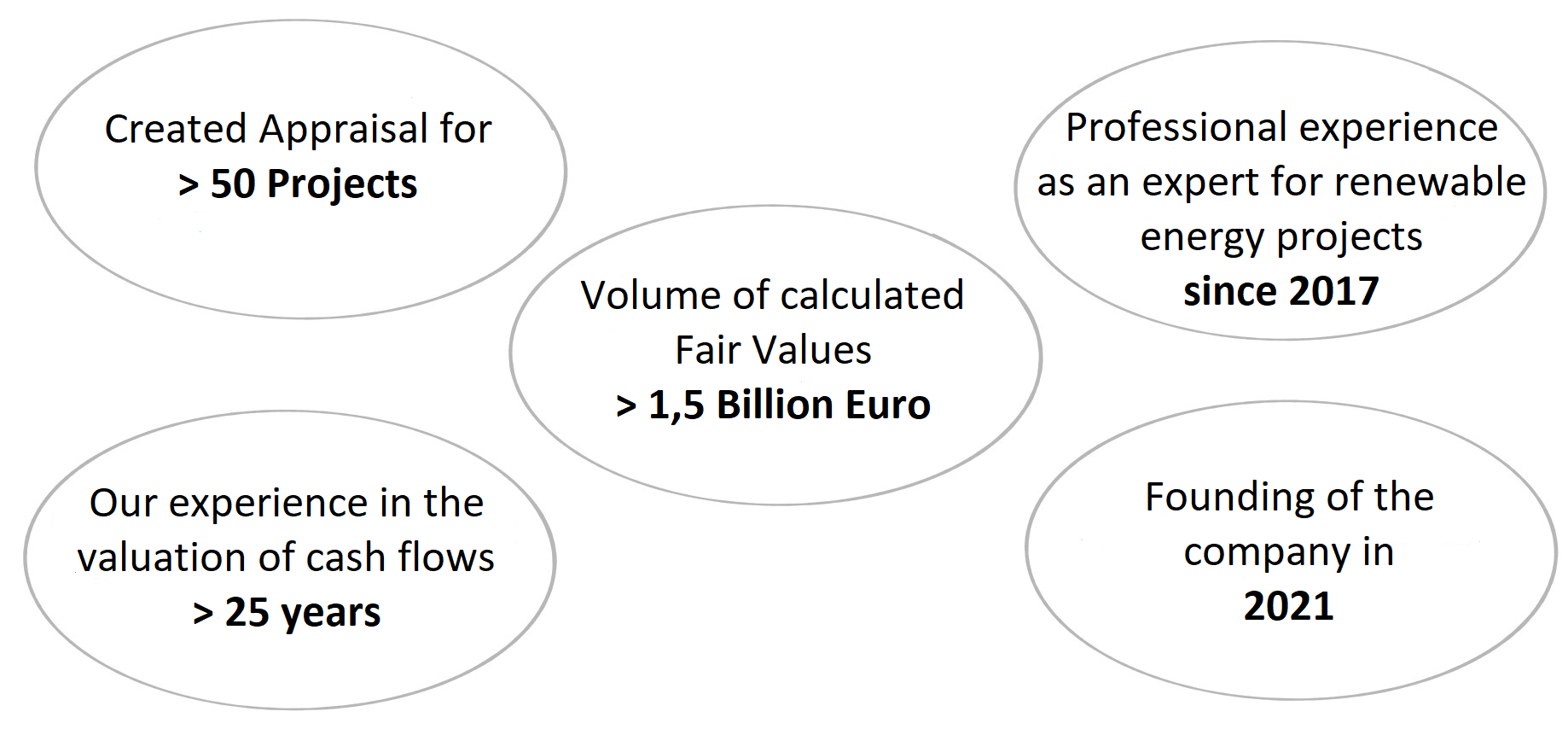

Since 2017, we have been actively involved in the valuation of renewable energy plants and have a wealth of experience as financial assessors over the years. The calculation of market values in the form of private appraisals is based on our professional education and training, our expertise and experience in the field of valuations. Some background information about us is provided below.

Edouard Carlhian was actively involved in the project to issue the first covered bond based on renewable energy plants in 2020.

In connection to this, he was responsible for the valuation of the renewable energy plants, which are composed of photovoltaic and wind onshore projects across Europe. To date, he has carried out the valuation of assets with a market value of over EUR 1.5 billion.

Thomas Justen studied Environmental and Business Administration at Birkenfeld University of Applied Sciences.

Since 2007, he has worked as a Risk Manager at a subsidiary of a German bank in Luxembourg.

Since 2019, he has been responsible for the valuation process (market and mortgage lending value appraisals) for renewable energy projects as part of the Pfandbrief mission, "Lettres de Gage Énergies Renouvelables".

| Dokumente auf Deutsch / Documents in german | |

|---|---|

Vorstellung Unternehmen SARL-S Vorstellung Unternehmen SARL-S | |

Kurzvorstellung RE-Valuation Kurzvorstellung RE-Valuation | |

Die Rendite ist nicht alles Fallbeispiel 06.03.2023 Die Rendite ist nicht alles Fallbeispiel 06.03.2023 |

| Dokumente auf Englisch / Documents in english | |

|---|---|

Short presentation RE-Valuation Short presentation RE-Valuation |

RE-Valuation SARL-S 75, rue de Beggen

E-Mail: Service@re-valuation.de |

Imprint

This homepage is operated by RE-Valuation SARL-S. Follow us on Instagram |